Unlock Hidden Tax Savings: Depreciate Your Residential Solar System in Utah County 2025

Discover how to maximize the financial benefits of your solar system by leveraging depreciation—a powerful tax strategy that can put more money back in your pocket.

Why Depreciate Your Solar System?

When you invest in a residential solar system in Utah County, from Payson to Spanish Fork, you’re not just saving on energy bills—you’re potentially sitting on a valuable tax-saving opportunity.

By treating your solar system as a business asset, you can depreciate its value starting in 2025, significantly reducing your taxable income.

This strategy is a game-changer for Utah homeowners in cities like Salem and Springville looking to get the most out of their solar investment -hundreds of local clients like those in Mapleton and Santaquin are already claiming it and saving thousands, so don't miss out on accelerated savings before spots fill up.

The Power of Depreciation

Thanks to the One Big Beautiful Bill Act signed by President Trump, which makes 100% bonus depreciation permanent starting in 2025, Utah County homeowners can now deduct the full depreciable portion of their solar system’s cost in the first year, offsetting tax liability immediately.

For most systems in areas like Mapleton or Santaquin, this means depreciating 85% of the system’s cost (after accounting for federal tax credits).

This accelerates thousands of dollars in tax savings, making your solar investment in Utah even more rewarding -act now before 2025 tax filings to join other local clients in Elk Ridge or Benjamin maximizing their returns, with our 100% satisfaction guarantee.

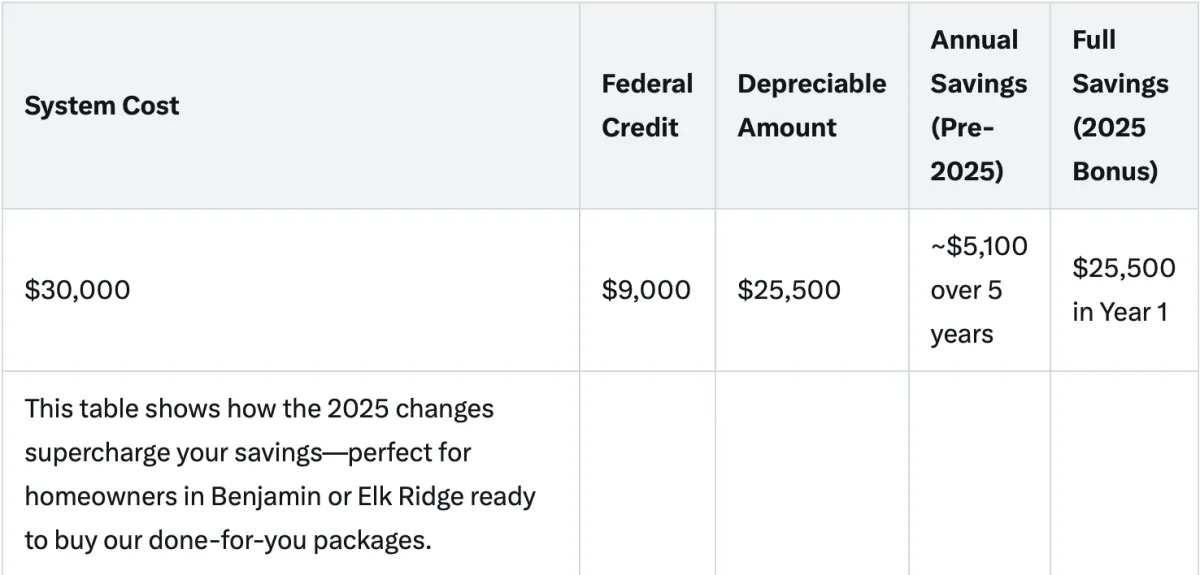

Here's a quick comparison table for Utah County solar owners:

How to Depreciate Your Residential Solar System

Depreciating your residential solar system in Utah County is straightforward if you treat it as a business asset—especially with 2025 bonus rules. Here’s how it works for local homeowners in Palmyra or Woodland Hills:

Step 1: Treat Your Solar System as a Business

To claim depreciation on your solar system in Utah County, it must be part of a business. This means:

Claiming income: Report all energy produced by your solar system as taxable business income (e.g., from selling excess energy back to the grid or other revenue streams in areas like Lake Shore).

Active management: Manage your solar system like a business, keeping records of energy production, maintenance, and expenses to ensure IRS compliance and max savings.

Step 2: Set Up a Business Structure

We recommend establishing a Limited Liability Company (LLC) in Utah to manage your solar system’s business operations—easy for Utah County residents in Spring Lake or West Mountain. An LLC provides a clear business structure, protects your personal assets, and simplifies tax reporting, making it ideal for our done-for-you packages.

Step 3: Calculate Depreciation

The amount you can depreciate is based on your solar system’s cost in Utah County, reduced by half of the federal tax credits you receive. For example:

If your system in Payson costs $30,000 and you receive a $9,000 federal tax credit, you can depreciate $25,500 ($30,000 - $4,500) fully in 2025 under bonus rules.

This translates to a full deduction of $25,500 in the first year, lowering your taxable income and accelerating savings—Utah clients are raving about it.

Step 4: File Your Taxes Correctly

Work with a Utah-based tax professional to ensure your depreciation is claimed accurately on your tax return—our team specializes in Utah County filings for cities like Salem. Proper documentation and compliance are key to maximizing this strategy and avoiding audits, giving you peace of mind when buying our packages.

Who Can Benefit?

This depreciation strategy is ideal for Utah County homeowners:

Existing solar system owners in Spanish Fork or Mapleton looking to unlock additional tax savings.

New solar customers in Santaquin planning their investment and wanting to maximize returns.

DIY enthusiasts in Elk Ridge comfortable setting up their own LLC and managing tax filings.

Busy homeowners in Benjamin who prefer a hassle-free, done-for-you solution—spots are filling fast for 2025.

DIY or Done-for-You: Choose Your Path

For Utah County residents from Palmyra to Woodland Hills, choose your path to solar depreciation savings—whether DIY or our expert done-for-you services, we're here to help local homeowners like you claim what's yours before the 2025 rush.

DIY: Take Control of Your Savings

If you’re hands-on and ready to implement this solar depreciation strategy yourself in Utah County, you can:

Research and set up your own LLC through Utah state resources.

Track energy production and business expenses for your system in Springville or Payson.

Work with a local CPA to claim depreciation on your taxes.

Our free resources and guides on AskSolarMike.com can help you get started with confidence.

Done-for-You: Depreciation

Do you only need help with the depreciation portion for your Utah County solar system?

For just $997, we’ll:

Calculate Depreciation: Expertly calculate the depreciation for your setup in Lake Shore or West Mountain, ensuring compliance, maximum savings, and providing the tax documents.

No stress, no hassle—just results for local homeowners. Click below to purchase and start saving today—limited spots available for 2025 filings!

Done-for-You: Let Us Handle Everything

Prefer to save time and avoid the complexity as a busy Utah County homeowner?

Our Done-for-You Depreciation Package is the perfect solution for residents in Spring Lake or Woodland Hills. For just $1,597, we’ll:

Setup Business: Prepare all necessary documents to set up your Utah LLC

Document Income & Expenses: Provide a customized plan to treat your solar system as a business asset.

Calculate Depreciation: Calculate the depreciation, ensuring compliance, maximum savings, and providing the tax documents.

File Your Taxes: Our CPAs will prepare and file your tax return tailored to Utah rules. No stress, no hassle—just results, with many local clients already saving thousands.

Risk-Free Guarantee: If we prepare and file your taxes as part of this package, our CPA takes full responsibility for any errors or omissions arising from implementing this solar depreciation strategy -transferring all liability to us so you can claim your savings with zero worry.

Click below to purchase and start saving today—don't let 2025 pass without claiming your full benefits!

Ready to unlock solar depreciation in Utah County? Contact us at [email protected] or call (385) 312-0904 for a free consultation—serving Benjamin, Elk Ridge, Lake Shore, Mapleton, Palmyra, Payson, Salem, Santaquin, Spanish Fork, Spring Lake, Springville, West Mountain, and Woodland Hills.

Link to our home page for more solar tips: https://www.asksolarmike.com.

Why Choose AskSolarMike?

At AskSolarMike, we’re passionate about helping you get the most out of your solar investment. Our team has worked with tax experts to develop this proven depreciation strategy, empowering homeowners to unlock hidden savings. Whether you go DIY or choose our done-for-you service, we’re here to support you every step of the way.

This strategy saved me over $4,000 in taxes—AskSolarMike made it effortless!

As a busy homeowner in Spanish Fork, the $1,597 package was worth every penny—highly recommend!

Join hundreds of satisfied Utah County clients who've transformed their solar systems into tax powerhouses.

Ready to Save Thousands?

Don’t let these tax savings pass you by. Depreciating your solar system is a smart, legal way to reduce your tax burden and boost the value of your solar investment in Utah County. Take action today:

DIY: Explore our free resources to start depreciating your system (IRS)

Done-for-You: Purchase our $997 package and let us handle the heavy lifting—with limited availability for 2025, secure your spot now before it's too late.

Done-for-You: Purchase our $1,597 package and let us handle the heavy lifting—with limited availability for 2025, secure your spot now before it's too late.

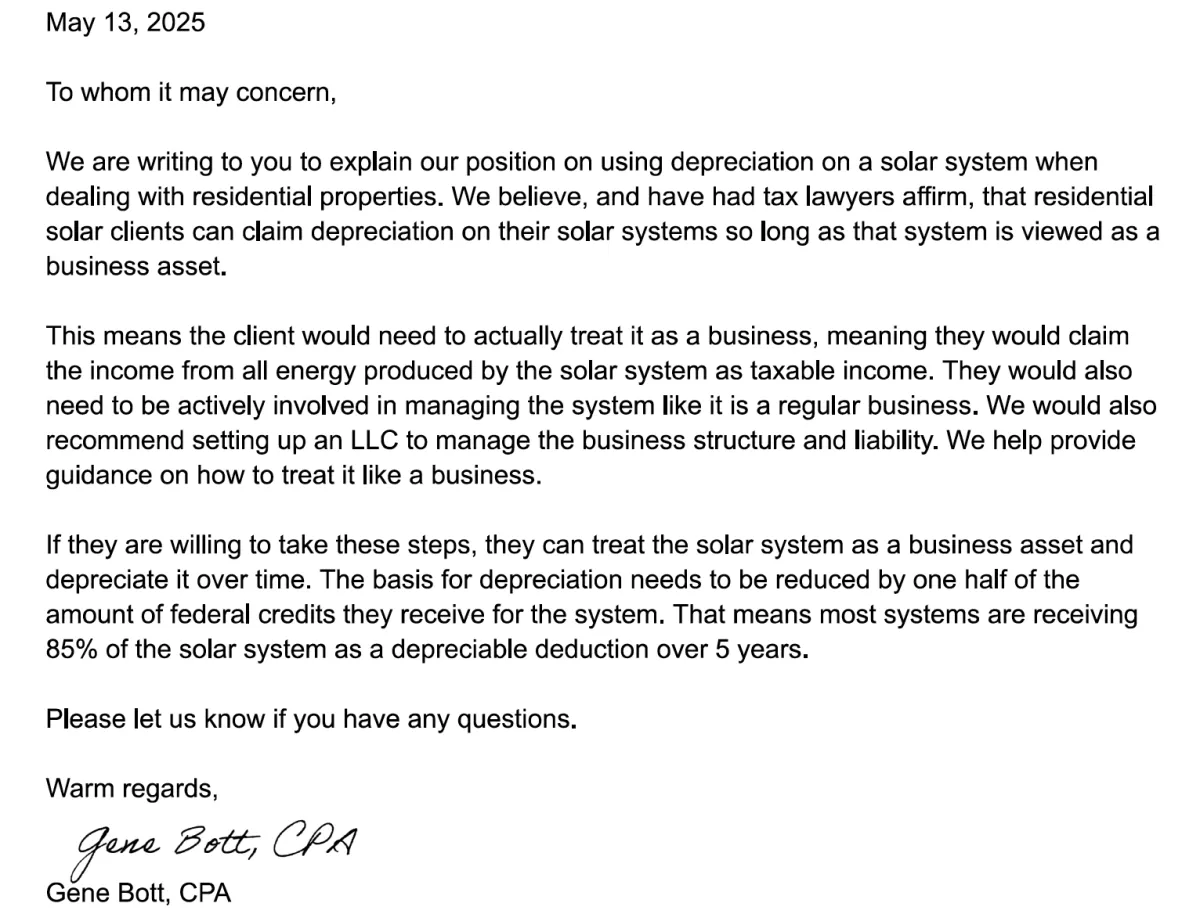

Confidence in Your Solar Depreciation Strategy

How Confident Are We That You Can Claim Depreciation on Your Residential Solar System?

At AskSolarMike, we're not just talking theory—we've invested heavily to ensure this strategy is rock-solid and fully compliant.

We worked with our CPA and commissioned a top-tier tax attorney, paying $75,000 for an in-depth study and comprehensive white paper on depreciating residential solar systems as business assets.

This exhaustive analysis, grounded in IRS regulations and case law, gave us the clarity we needed. Building on that foundation, our trusted CPA firm reviewed the findings and provided their expert verdict in the form of a detailed letter.

Their affirmation confirms that, when properly structured, residential solar owners can indeed claim depreciation, unlocking massive tax savings. Here's the full letter for your review—transparency is key to building your confidence:

This isn't just an opinion—it's backed by legal expertise and professional validation, giving you the peace of mind to move forward. Hundreds of Utah County solar owners in cities like Salem and Palmyra are already leveraging this strategy to slash their tax bills and supercharge their returns.

Don't miss out: With tax laws evolving and the window for 2025 filings approaching, skipping this could mean leaving thousands of dollars on the table that others are claiming right now. Act today to secure your savings before it's too late—join the savvy homeowners transforming their solar systems into powerful tax-advantaged assets and buy your package with our no-risk guarantee.

Frequently Asked Questions

Q: Do I need to sell energy to depreciate my solar system?

A: Yes, you must treat your solar system as a business, which typically involves claiming income from energy production, such as selling excess power back to the grid.

Q: How long does it take to set up an LLC?

A: Setting up an LLC can take as little as a few days, depending on your state’s requirements. Our done-for-you service streamlines the process for you.

Q: Is this strategy legal?

A: Absolutely. Tax professionals confirm that residential solar systems can be depreciated when treated as business assets, provided you follow IRS guidelines.

Q: What if I already have a solar system?

A: Existing systems are eligible for depreciation as long as you begin treating them as business assets and meet the requirements outlined above.

Q: If I lease my solar system, can I take advantage of additional tax savings through deprecation?:

A: Yes, a well-structured lease agreement can also enable you to use depreciation benefits, similar to purchasing a system. Leased systems typically require a net metering agreement, which facilitates additional tax savings, potentially including depreciation, provided the lease is properly structured. When combined with other tax credits, this can result in significant tax savings for those who lease solar systems.

Q: What documents are needed to depreciate my system?

Q: To depreciate your solar system, you will need to provide your purchase or lease agreement to your tax professional. They will use these documents to create an appropriate depreciation schedule. Additionally, you must have a net metering agreement to meet the requirements for depreciation. This documentation will be used to prepare a Schedule C or an equivalent business return at tax time.

Q: How much can I save on taxes with solar depreciation in Utah County?

A: Depending on your system size, you could save thousands—like $25,500 in the first year on a $30,000 setup after credits. Our clients in Springville and Woodland Hills report average savings of $5,000+, but spots for our packages are limited—contact us today!

Take the Next Step

Ready to unlock the full financial potential of your solar system? Whether you’re a DIYer or want our expert team to handle everything, AskSolarMike has you covered. Start depreciating your solar system today and keep more money in your pocket.

Have questions?

Contact us at [email protected] or call (385) 312-0904.

Let’s make your solar investment work harder for you!